A brief humanist summary to traditional investors

PART 1 – I find that familiar

What I love about the science of Economics is that even cold hard truths are mutable in the long run. Sort of like the way we surfers conceive our dogmas (I still feel that Tom Curren is the paradigm of how to surf, paradoxically). For example, before Adam Smith came up, French physiocracy decreed that mother nature is the only real wealth creator, whereas humans account for the mere transfer or repackaging of it. Smith found that was absurd, thus proposing that wealth is actually a function of human sweat. Lacking better metrics, however, the so-called classics measured value based on its cost in hours of work.

In retrospect, of course, it is clear that technological constraints define not only what we do in practice, with our hours of life, but also our reflexive reach about what we are, as homo economicus. Anyone who agreed with Smith in 1700 France would be considered illiterate in economics.

I find that accusation familiar today.

Only much later did someone (Schumpeter) raise technology and innovation to the center of the creation debate, thus referring to the modern notion of productivity. Not coincidentally, Schumpeter was born in Europe at the end of the nineteenth century. France was living the Belle Epoque; England, the Victorian Era. In the Americas, meanwhile, the USA lived its Gilded Age. There were many names for the same wave of prosperity and unprecedented development in the West, triggered from the First Industrial Revolution, decades before. In an industrial revolution, developments are exponential and derivatives are unpredictable. The process is geometric and successive.

The book Empires of Light (Jill Jones) tells the story of the industrial race for electricity at the end of that century (19th), led by the contrasts of Thomas Edison, Nicola Tesla and George Westinghouse. There are many parallels between the race of three and the current blockchain (L1s) war. If public opinion was incapable of inferring that television would come from there, what about computers? Exactly one century later, however, Bill Gates was mocked by David Letterman on a TV show when he presented his vision of what the internet would be. To Letterman’s ears, it seemed to be of no use at all.

I find that familiar today.

In that same year (1995), Marc Andreessen had to explain to a US Congress Committe why the hell would someone other than a terrorist be interested in transmitting encrypted data online. Netscape invented and marketed SSL, the protocol that paved way to the distant concept of e-commerce (so distant that politicians could not reach). To do so, SSL used a principle that was exclusive to the army: cryptography. Because the word “crypto” carried as much weight as the word “nuke”, Netscape could only sell overseas their most substandard software versions, following same restrictions imposed on companies in defense industry. But since a protocol is just math, that never stopped other countries from copying it. It only slowed the US a bit.

Again, I find that familiar today.

One of my favorite history gems on Youtube is an old lecture (from 1999) by Peter Thiel, in which he presents his vision on how the invisible hand of virtual capitalism would lead societies to such an unprecedented level of economic self-governance that the main tool used for that, money, would probably no longer require a public employee driving it. Judging by Thiel’s assertiveness, Satoshi Nakamoto’s discovery ten years later was as random an occurrence as it was inevitable.

When I first bought into Bitcoin, in 2014, I was warned that it was the new Tulip Fever (1636-37). Although I recognized the logic of that assumption (especially for those who have read not much more than 140 characters of each of the two things), I just couldn’t see it. First, the Dutch event took place practically immediately after the premiere (1611) of the very concept of retail stock investors financing capitalism at scale (or the VOC, the Dutch East India Company). Tulips were just the popular spices in front of an uneducated demand from new investors, in a financial market that would need to burst a bubble to consolidate itself.

Secondly, Satoshi Nakamoto had simply and robustly elucidated a math technique for a “peer-to-peer electronic cash system”, exposing not just computational elegance but microeconomic precision: in face of innovation, the payments industry (+US$500bn cap, revenue of over US$100bn) would become expensive and inefficient, according to its original thesis (which I never subscribed to, ironically). Why would a software that supposedly retires the expenditure of over $100bn not have “intrinsic value”? Furthermore, it is not that the Winklevoss bros and thousands of others, including myself, have never been allowed into capital markets or speculative ownership of anything before.

Nonetheless, it was Jamie Dimon’s time to say that everything was familiar, if one have just heard about the Tulip mania.

In 2016, three months before discovering Ethereum, I came across the book The Third Wave, by Steve Case (founder of AOL). Case foreshadowed the “third wave” of the internet, in which entrepreneurs would finally transform “the real world” and, to do so, would have to act in coordination with regulators, kind of like or more than in the first wave, and unlike the second wave. As a surfer, I never skip books about waves. The book never mentioned blockchains or cryptography (if I recall correctly), but its analytical acumen fits perfectly with the idea of Web 3 which, in this sense, is also an inevitable occurrence.

Fast forward to 2020, and the financial industry’s sentiment pivoted. Probably pricing in (at above zero) the chance of their own Kodak moment, this came not from the extra time off to study but certainly from the extra M2 (in this sense, the bubble condition was always obvious, and not very relevant). Two years later, as liquidity disappeared, everything everywhere all at once in crypto (except maybe BTC) is all a scam, once again.

And that too is very familiar!

Here is a list of immediate tech breakthrough reactions throughout history, compiled by Morgan Stanley Researchers (not me!):

Rail (1800): “Rail Travel at high speed is not possible, because passengers, unable to breath, would die of asphyxia” (Dr Dionysys Larder – Professor of Natural Philosophy UCL – 1800)

Electricity (1860): “Electricity will be a fad.” (Junius Morgan – Father of J.P.Morgan – 1860)

Telephone (1876): “This telephone has too many shortcomings to be seriously considered as a means of communication.” (Western Union Internal Memo – 1876)

Light Bulbs (1880): “Everyone acquainted with the subject of light bulbs will recognise it as a conspicuous failure.” (Henry Morton – President of the Stephens Institute of Technology – 1880)

AC Power (1889): “Fooling around with alternating current (AC) is just a waste of time. Nobody will use it, ever.” (Thomas Edison – Inventor – 1889)

Flight (1902): “Flight by machines heavier than air is unpractical and insignificant, if not utterly impossible.” (Simon Newcomb – Canadian Astronomer and Mathematician – 1902)

Automobiles (1903): “The horse is here to stay, but the automobile is only a novelty, a fad.” (President of Michigan Savings Bank – 1903)

Cinema (1916): “The cinema is little more than a fad. It’s canned drama. What audiences really want to see is flesh and blood on stage.” (Charlie Chaplin – Actor and Director – 1916)

Radio (1921): “The wireless music box has no imaginable commercial value. Who would pay for a message to no one in particular.” (David Sarnoff – Technology Investor – 1921)

Film (1927): “Who the hell wants to hear actors talk?” (H.M.Warner – co-founder of Warner Brothers – 1927)

Television (1946): “Television won’t last because people will soon get tired of staring at a plywood box every night.” (Darryl Zanuck – Movie Producer at 20th Century Fox

Satellites (1961): “There is practically no chance satellites will ever improve telephone, television or radio reception within the United States.” (T. Craven – FCC Commissioner – 1961)

eCommerce (1966): “Remote shopping, while entirely feasible, will flop.” (The Futurists – Time Magazine – 1966)

PCs (1977): “There is no reason for any individual to have a computer in his home.” – (Ken Olson, Chairman of Digital Equipment Corporation – 1977)

Memory (1981): “No-one will ever need more than 637KB of memory in a computer. 640KB ought to be enough for anybody.” (Bill Gates, CEO of Microsoft, 1981)

Mobile Phones (1992): “The idea of a personal communicator in every pocket is nothing more than a pipe-dream fuelled by greed.” (Andy Grove – CEO of Intel – 1992)

Digital Media (1995): “The truth is no online database will replace your daily newspaper.” (Clifford Stoll – Newsweek Article entitled ‘The Internet? Bah! – 1995)

Internet (1995): “I predict that the internet will go spectacularly supernova, and in 1996 it will catastrophically implode.” (Robert Metcalf – Inventor of Ethernet – 1995)

Internet (1998): “The internet will fade away because most people have nothing to say to each other […] no greater than the fax machine.” (Paul Krugman, renowned Economist – 1998)

Music streaming (2003): “Subscription models for music are bankrupt. I think you could make the Second Coming of Jesus on subscription and it wouldn’t be successful.” (Steve Jobs – CEO of Apple – 2003)

Video streaming (2005): “There’s just not that many videos I want to watch.” (Steve Chen – CTO and co-founder of YouTube – 2005)

iPhone (2007): “There’s no chance that the iPhone is going to get any significant market share. No chance. It’s a $500 subsidized item.” (Steve Ballmer – CEO, Microsoft – 2007)

Cryptocurrencies (2018): “In terms of cryptocurrencies, generally, I can say with almost certainty that they will come to a bad ending.” (Warren Buffett – Investor – 2018)

PART 2 – Start with why

Richard Feynman said that the greatest physics lesson he received from his father in childhood was that no one knows why Newton’s Laws exist. Nonetheless, when asked by their children about why a body tends to the ground, most parents are quick to summarize how gravity works, as if that answered the question. The same seems to hold true for some crypto fund managers. Yes, if all you need is a pack of tech researchers that won’t make the money decisions themselves, those kids should work out greatly. But that’s not how I add up to the family.

If you take the Goldman Sachs list in the previous chapter, all of those statements express the same establishment feeling in face of new disruptions, making the same mistake of confusing tech restrictions with revealed preference (Samuelson). But when we (as a collective intelligence) demonstrate that something is possible, scalable and probably efficient (plus offering upsides that are unimaginable, by definition), one simple question is to my mind very useful to forecast whether something will stick or not: what is the net account of effort/hardware in the pivot? Is the promised magic reached through the addition of consumer’s effort (or hardware inventory) or subtraction (less work and less gadgets)? If the answer is the latter (subtraction), the financial bet is a lot safer. Because life is easier.

Now, this is one of the reasons why I don’t believe in Ethereum’s L1 supremacy in the long run. But we will get to that. For now, the point is that “crypto is the new Wall Street” may be an understatement. In my understanding, crypto is the new “everything”: the new Wall Street, the new Hollywood, the new University and even the new Brasília or Washington. That is because the exact same social function of each of these social entities tends to be obtained more efficiently using computational protocols (instead of analog protocols), or in other words, orchestrating ourselves with tokens.

Whaaaat???

Ok, let’s talk what.

Since the 1980s, computer science was trying to solve a computational problem that real life’s accounting calls double-spending. While in the world of atoms it is impossible for a surfer to sell his surfboard and at the same time preserve it in his garage, in the digital world of bits, contrary, the same object can inhabit infinitely different folders. Have you ever sent nudes and regretted it? “Send me back” is pointless, as you know. If this seems like a tangible but almost irrelevant problem (in a matrix of risks for economic development), remember: Edison’s lightbulb was also initially understood in this way (he did not exactly invent incandescent lighting, but rather made an old science viable).

Satoshi Nakamoto, in 2009, published the definitive solution to the problem. It is safe to say “definitive” if what matters is the proof of concept, only. Markets do the rest. Which is why we are here.

Essentially, a blockchain is just another software template, something that replaces millions of pieces of hardware. The only difference is that it transcends, computationally. This is because the hardware it dematerializes is the very conceptual framework of social institutions that sustain the political complexity of a modern society.

This is computation 101, actually. My son who loves Lego knows it intuitively. Over time, a complex system receives marginal updates towards successively marginal gains. But the best thing achievable is the optimization of a previous status quo. For example, Charles Medina could optimize my potential as a surfer, but he couldn’t turn me into a world champion, as he did with Gabriel. Even Gabriel Medina cannot be world champion forever. At some point he will stagnate, while the sport (demand) will not. So it will be technically more likely and economically more feasible to build the next title from a fresh younger grommet. Computers are the same. The next generation makes a buffer 10% wider, the other generation too. At some point, the arrangement of the pieces becomes the limit, by itself. You have to scrap everything and build another one from scratch (PCs are rebuilt from scratch every ten years, whereas political systems take way longer).

Blockchains are a big deal because they revolutionize the very concept of software. And they do so by reverting the entire hierarchy of computation. By definition, any other software is subject to a hardware (server, warehouse, programmer…) which in turn is subject to a human agent (company) that may change his mind at his will. Blockchains, on the contrary, are sovereign codes, while any (human) hardware connected to them is submissive. “God is witness”, say old religious tribes. Blockchains formalize this, empirically.

From now on, we can store, value and transact any and all data relating to our past and present lives in a common (public) register that even so does not expose us, but proves to the world whatever we need to prove about ourselves. Decentralization means sovereign software, and its the basis for a true digitalization of societies. This is like going from a 1789’s Rousseau software to the e-Social Contract, and couldn’t possibly happen overnight (a decade or two).

But solving the double-spending was the genesis for that, in my view.

Smart contracts are very smart

The first version of blockchain to go live was the Bitcoin Network. BTC talks, however, deserve another letter (spoiler: the thesis of digital gold and its problems). Going forward here, I shall only state that the Bitcoin Network is a very precarious computer: besides somewhat slow, it does not accept any programming.

Hence in 2015, this issue co-opted a worldwide legion of stunned nerds who all migrated then to Zug, Switzerland. In response to the limitations imposed by Bitcoin’s architecture, they created another cloud computer, this time one where anyone could program things. They called it Ethereum Virtual Machine.

The programability in question (how can any human program a software that is supposedly sovereign?) is done by smart contracts. As the name implies, they are self-executing contracts that unleash event B if event A happens (it self verifies that), successively. One may say “Wait, I can do that with traditional software, I can program triggers!”, which of course is true. There is only one, huge difference: traditionally, “you” have to do that while your service provider has to be honest/competent enough to comply. A traditional software has to offer triggers inside its own applications, and you have to trust the service provider to hold up his end. It’s all based on trust, ultimately.

That is not the case with a sovereign, open source smart contract, however. If you borrow money from someone else locking in a collateral in a smart contract, the lender cannot possibly steal your collateral and disappear, even if he wants to be a criminal. Therefore, smart contracts change the fabric os human relationships from “should not be evil” to “cannot possibly be evil even if I want to“.

It’s about replacing trust with true. Who needs trust when you already have the data?

Wait. How?

Here is a brief summary of the internet. Browsing the web is just as free as watching television was in the 1960s. That is because what Google (and everyone else) sells is fundamentally the same of what TV Studios already used to sell half a century ago: our attention. Today, thousands of companies pay tens of billions of dollars annually for our metadata. But they pay the FANGs, not to ourselves. It’s intuitive to imagine yourself as the customer and not the product. But customers pay! Internet’s real customer is not the citizen but the advertising industry, typically.

You are the product for sale (up until now).

The metadata economy is a perfect proxy for feudalism: without alternatives, the peasant (user) steps “at his own free will” on new ground, which guarantees him a livelihood and benefits that he would otherwise (?), in the offline world, never have. The land is freely accessible, but it is also a private space. So in exchange for the right-to-use, users grant to the landlord their own individual sovereignty, literally. That way, if someone wants to convince you to vote for Bolsonaro or ask about your willingness to subscribe to a service, it deals with the platform owner (wholesale), not with you. The landlord sells your information or directs your behavior (or both). The user is free to leave, but is also doped to stay. Google and Facebook are digital physiocracies where the only means of economic ascension for users is collaborating in co-opting and maintaining other users online. Kind of like Samuel L. Jackson in the movie Django.

This came not from malice of the nerds but from tech limitations. In sense of our virtual procrastinations, blockchains are the transition tool for us from feudalism to capitalism. And the nickname for this new internet regime is Web 3. Coined by one of the creators of Ethereum, Gavin Wood, the term Web 3 encompasses everything.

In a definition popularized by Chris Dixon (a16z):

“Web 3 is the user-owned internet orchestrated by tokens.”

In summary, Web 1 would be the internet in the 90s, with its “information wants to be free” ethos and precarious monetization structures (thus precarious services). From the user’s point of view, it was also the “read only” internet (Chris Dixon’s definition).

Web 2 would be the web from around 2002-2005 to these days, where FANGs turned the user into cattle by hiring neuroscientists and behavioral experts, thus outpacing regulations and general culture. It is when precariousness is resolved and unprecedented value is created. Also called the “read-write” phase, as users became output creators as well.

Web 3, which starts with crypto, promises to be the “read-write-own” era. Users becomes master of themselves, reversing the bargain over their own data. Thus, while the efficiency of Web 2 (economic incentives for human capital) are preserved, the ethos of Web1 (democracy, freedom, access, etc.) would finally be real.

Dance to the music

Eyeing such promises is, for example, the music industry. Musicians would say that “the internet was cruel to artists”, but it would be more accurate to say that Web 1 was cruel, by ignoring intellectual property, and Web 2 even more so, emptying their bargains in favor of the owners of private algorithms. The internet orchestrated by tokens would be the triumph of the creative artist, if his fingerprint grants him royalties automatically, regardless of any aesthetic manipulation or creative complexity to which his work may be subjected, by greedy decisions of third parties.

The exact same principle, however, applies to entrepreneurs creating killer algorithms and protocols seeking gains at scale (concentration). So capitalism is not discouraged, which is good! Nonetheless, corporations may be discouraged to exist at some degree, as the workforce is able to coordinate itself autonomously. But in retrospect, that is not as surprising as it may seem…

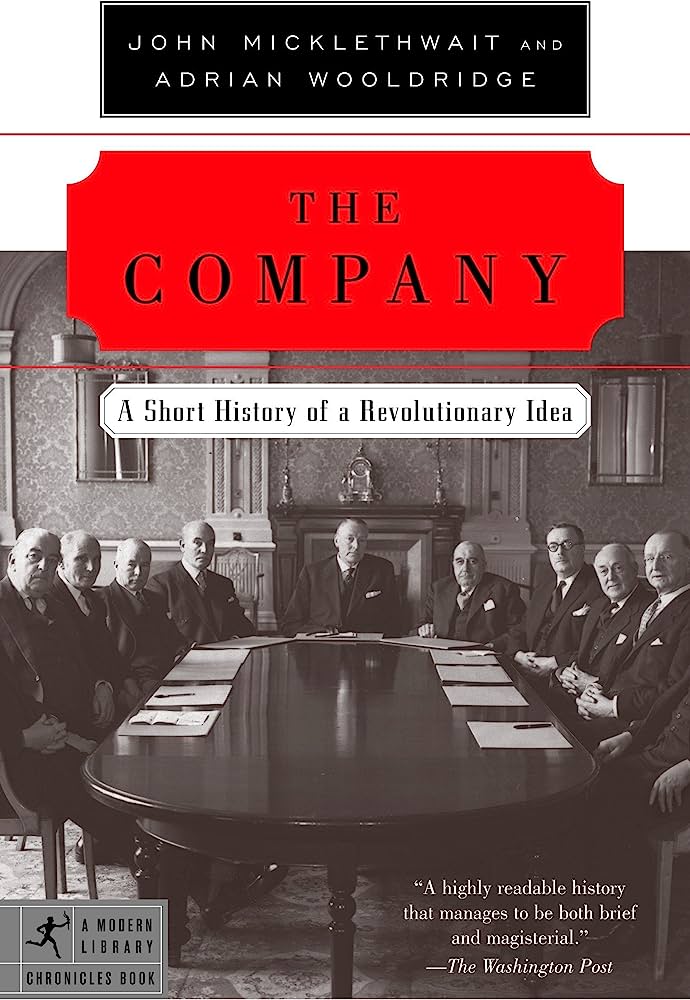

Another fantastic and suggestive book to this novel is The Company: A Short History of a Revolutionary Idea. In it, one learns how the idea of enterprises evolved throughout the centuries (from royal and chartered enterprises to the LLC), both in response to emergent needs (navigations, railroads) and also creating even more needs (stock exchanges, for instance) in a chicken-egg pattern. But think about, for a second, what a company actually is. According to Simon Sinek, a company is the gathering of a group of people who believe and seek something in common. According to academia (credit to Ronald Coase), in turn, a company is just a way of eliminating transaction costs between people who (together) produce something. Those are the two best definitions I know. As it turns out, “agents orchestrated by tokens” can theoretically serve both definitions even better, in most cases.

Your children will work for sovereign protocols, eventually. Even if they share office space with a real team where roles are pre-defined.

Citizenships will also be orchestrated by tokens. If your child goes missing and someone else’s private camera spot her, you’ll be immediately notified of the location. That does not sacrifice privacy (quite the contrary) and should be faster than calling the police, asking them to do the same thing manually. Same thing if you fall unconscious on a sidewalk in a foreign country. Any bypassing medical doctor will get access to your medical record, from your ID. No one else will, though.

Remember, blockchains are literally public machines in software.

(Balaji Srinivasan wrote a book about it: “The Network State: How to Start a New Country“. I challenge the reader to point out another wholly new engineering essay in political science, written in the last one hundred years or so. There isn’t, similarly like Radical Markets (Weyl/Posner) is the only totally new proposition to economics.)

WARNING: Again, none of this should happen overnight. While Defi and digital commodities are both tech realities, conceptually, they may take decades to become social realities. This fact of life tends to crush investors that are not market makers, like retail ones.

PART 3 – So where are we now?

If you’re reading this in 2023 and hold stocks in your portfolio, you must be following the AI frenesi in some degree. Maybe you came to the conclusion that AI is real while crypto is not, as most people in Wall Street did. In a sense that Nvidia’s revenues are very real while Web 3 has none, I would sure agree with that. In a sense that most Nvidia’s customers are clueless startups (backed by teaser bets of VCs) that will most likely go to zero just like the dot com names from the late 90s did (therefore a ChatGPT killer won’t come from them), it is not unfair to label everything under the same tag, which typically spells b-u-b-b-l-e. And that is healthy! It is a necessary step towards the market success of a technology, not the opposite.

So, same as this bunch of AI entrepreneurs are burning investor’s money to buy H100s that will likely cost 10x less in two years, another bunch of entrepreneurs did suck all that extra (M2) money supply as much as they could by activating same old FOMO, as if we were already in the Web 3 future. A few things set crypto and AI investments apart, however:

Firstly, crypto success depends on a global network effect, while AI does not (in fact, one LLM adopter is even better off if nobody else in his industry follows suit). This makes the crypto runway way longer, before it takes off.

Secondly, most money entering crypto use the service of a vendor, someone that is more of a ferry boat than a gatekeeper. These are the exchanges, encompassing from the scammy FTX to the legit Coinbase and everyone else in between, especially Binance, which alone accounts (November22 data) for 75% of all global spot volumes (Coinbase’s volume share was 11.6%). Shepherding your own private keys is still a hassle, perhaps it always will be to most people (I personally don’t think so), and for institutional investors (already more than half of Coinbase’s AUC) its even more than that, a fiduciary problem. But the problem with exchanges is that they are themselves a legal/regulatory risk to your portfolio, which inhibits token ownerships, which inhibits use adoption. Moreover, they are both the antithesis of decentralization and the only software that most investors actually interface with.

Thirdly, scammers are everywhere in crypto because why wouldn’t they? Moreover, even if a nonsense is not a scam like FTX was, it is most likely not decentralized (or useful) either (like Celsius). To me, this say nothing about the technology itself, or about real and solid Defi protocols such as AAVE, for instance. Unfortunately (or fortunately?), most investors can’t see that way yet.

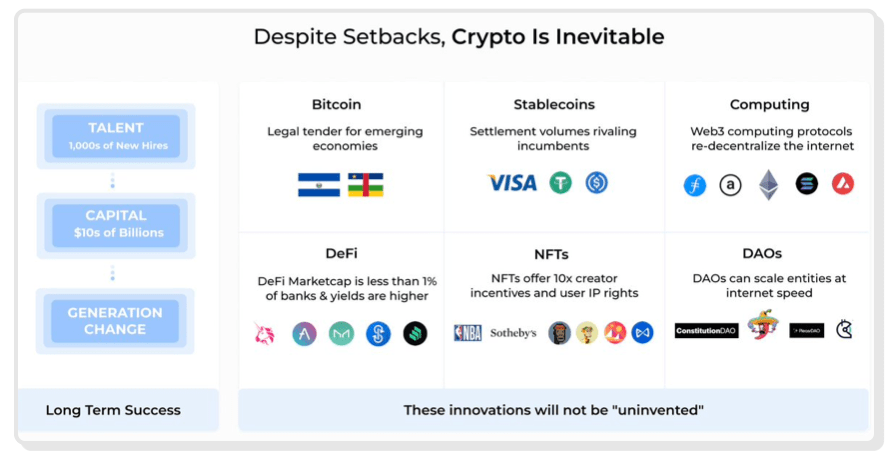

Inevitability

Honest question: when before in history so many minds tackled the same disruptive goal? High rewards and zero entry barriers make a powerful mix, something hard to bet against.

As Ryan Selkis wrote:

“Need a globally accepted asset that you can store in your head “just in case” you need to emigrate from a failing country? There’s Bitcoin. How about a platform that routes your app around Big Tech censors? There’s Ethereum and a multitude of emerging Layer-1 (“L1”) protocols. Can’t access cred- it? There’s DeFi. Hate 30-50% take rates for artists? NFTs. Trying to fund research for your own rare disease cure? DAOs.”

DISCLAIMER: If one is so confident of something (as I am of the above), even if it’s right, some mistakes may also be inevitable. By betting on Bitcoin as an alternative to fiat derivatives (such as bonds) and on altcoins as BTC betas, I always thought that QT wouldn’t haircut me. For that reason, I solely ignored all the warnings regarding the FED in 2021. I was obviously completely clueless about the relationship between disruptive tech investments and macro monetary cycles.

It is even harder to be open minded to read the markets in when you actually don’t want to. This is a mistake I hope to never make again. Ray Dalio’s Principles sure helped to realize my weaknesses. As for surfing macro in my position, there’s a book called The Great Wave (D H Fischer) which someone very credible told me to read, and I still haven’t.

PART 4 – Picking winners (Is that possible?)

In December 2016 I discovered Ethereum and got hooked by crypto for real (I also realized that my 10 BTCs bought almost three years before were gone forever, with a laptop stolen on a trip to Kauai in 2015). From all the exponential technologies that were promising abundance at that time, blockchains striked as the only one where any peasant could have a real shot. Basically, my allocation strategy was always an attempt to avoid type 1 errors (false positives) and get over countless type 2 errors (false negatives).

However, correlations between real infrastructure developments and token prices turned out to be negligible. For someone who spent years reading white papers as a full time job, this is something I have struggled to deal with.

In general, too many governance tokens hold zero intrinsic value, no matter how much the project succeeds. Moreover, lots of hot tokens are the exact textbook definition of unregistered securities, while many others trade at multiples that would be odd even with mainstream adoption (and some tokens are both). I probably would have made more money by studying cliches of TA such as Wyckoff Distributions, or by studying growth hacking and Google Analytics. But I didn’t, I have sticked with data driven milestones fundamentals.

As I way to share a more tangible feedback, this should summarize what I came to believe, generally speaking:

Yes, I think Ethereum is only Mosaic

While the concept of a blockchain is extremely simple, its full implementation (large scale, security and sufficient decentralization) is highly complex. So complex that Vitalik Buterin called this problem the Blockchain Trilemma: among those three issues (scale, decentralization and security) you can pick two, but cannot have all three of them.

Reactively, the industry behaved as if the trilemma was true, although it is not. Silvio Micali, MIT scientist and winner of the Turing Prize, has demonstrated that it is false. Lots of entrepreneurs ignored that, as they were already working on false solutions to non-existent restrictions. This happened typically above Ethereum.

And that is the fundamental problem with Ethereum. Designed by a small team and thrown online as a proof of concept (like the Wright Brothers’ airplane), its basic engineering is the result of a heuristic approach (intuitive assumptions), which is little or nothing scientific (ETH 2 follows same line). That starts with its own language, Solidity. On one hand it makes EVM accessible, but on the other induces programming to imperative mode, making the formal verification of things very, very difficult.

What will happen when the whole world economy lay itself on a blockchain and too many layers go behind every action?

It’s true that “learn as you go” is the formula for life (and The Lean Startup is a great bible that I have followed as an entrepreneur myself), but that doesn’t work out well for building infrastructure, when decisions are irreversible, in my view. For these cases, scientific formality is more than required.

Never bought Solana, though

When you jump into an arms race powered by free money, “speed to market” screams loudly. It is really hard to avoid the shortcuts that will kill you in retrospect. Specially if investors close their eyes dancing pump and dump.

So a team of Qualcomm emigrants used their credentials to co-opt famous investors, who were followed by their audience of retailers. Within a few months another “Ethereum killer” was worth US$77 billion (mkt cap), populated by an impressive amount of Dapps that won’t likely work at scale, security and decentralization. Instead, the network went down occasionally (off the air), which should be unbearable. True to be told, their high CDMA expertise seems to have saved them time when approaching blockchains without getting lost in abstractions and experiments that maybe were born wrong (as others did).

Similar discussions are pertinent to Layer 2’s (side chains, rollups), basically infrastructure support networks created to “by-pass” fundamental problems of the network below, such as scalability in TPS (transactions per second). As any student of human sciences knows, our interpersonal relationships are the integral of a bunch of layers of overlapping issues. Therefore, if we are going to digitalize everything, there is no reason to be different. But that doesn’t mean that a flaw on a layer below is ok or negligible by a way of compensation.

What’s in the portfolio?

One of the reasons for not advising on which L1 blockchains in my view should be the long term winners is that I don’t hold significant positions on them. Because even if I am right, picking great applications above them (trading at 100x less market caps) should be more rewarding.

Therefore, I am just another believer in the old 60-40 portfolio, except for the fact that here this means 60% BTC and 40% small cap alts.

Bitcoin is now considered a commodity, but unlike gold it won’t reach NASDAQ’s market cap by doing two or 3x. Instead, it will still be at 1.5 trillion by doing 3x now. So, all things in this essay considered, I find BTC a no brainer buy and hold.

Small cap alts, on the contrary, are highly risky. The diligence on them is a mix of classic SaaS diligence (milestones, data driven metrics) and social, subjective interpretations (demand, projections). Both of these two pillars are made of four or five steps, similar to what classic venture capital funds do for living.

By far, the biggest challenge to overcome in the ecosystem is overcapitalization. How to make builders incentivized if they pocket all the rewards in advance? This is a serious fundamental problem of the so called web 3 industry. While Ethereum was built with only U$18million, that is typically not the case these days.

Considering the fact this is an open letter, I will just finish by saying this:

Planet Earth’s human population will soon reach the nine billion headcount. Our GDP approaches a hundred trillion (usd) and assets exceed 5x that. A relevant fraction of that is about to be tokenized, over the next few decades.

If so, it is expected that we do so in the most scientifically and verifiable way possible

When it comes to infrastructure, the slow is smooth and smooth is fast.

Notes:

(1) This letter is a showcase of my way of thinking this through. It should be understandable by any investor who is not familiar with crypto instruments.

(2) This is not a Messari Report wannabe.

(3) It’s amazing how much output one can produce in a short time, when surfing is not an option.

(4) This is not financial advice.